Real estate is a top investment choice for many Kenyans, yet few take the leap. This blog explores the fears, myths, and barriers holding aspiring investors back and how to overcome them with the right support of a Real estate community of investors.

Ask any Kenyan about the best way to build wealth, and real estate is almost always top of mind . Land, rental property for sale, or owning an apartment are all considered smart, long-term investments.

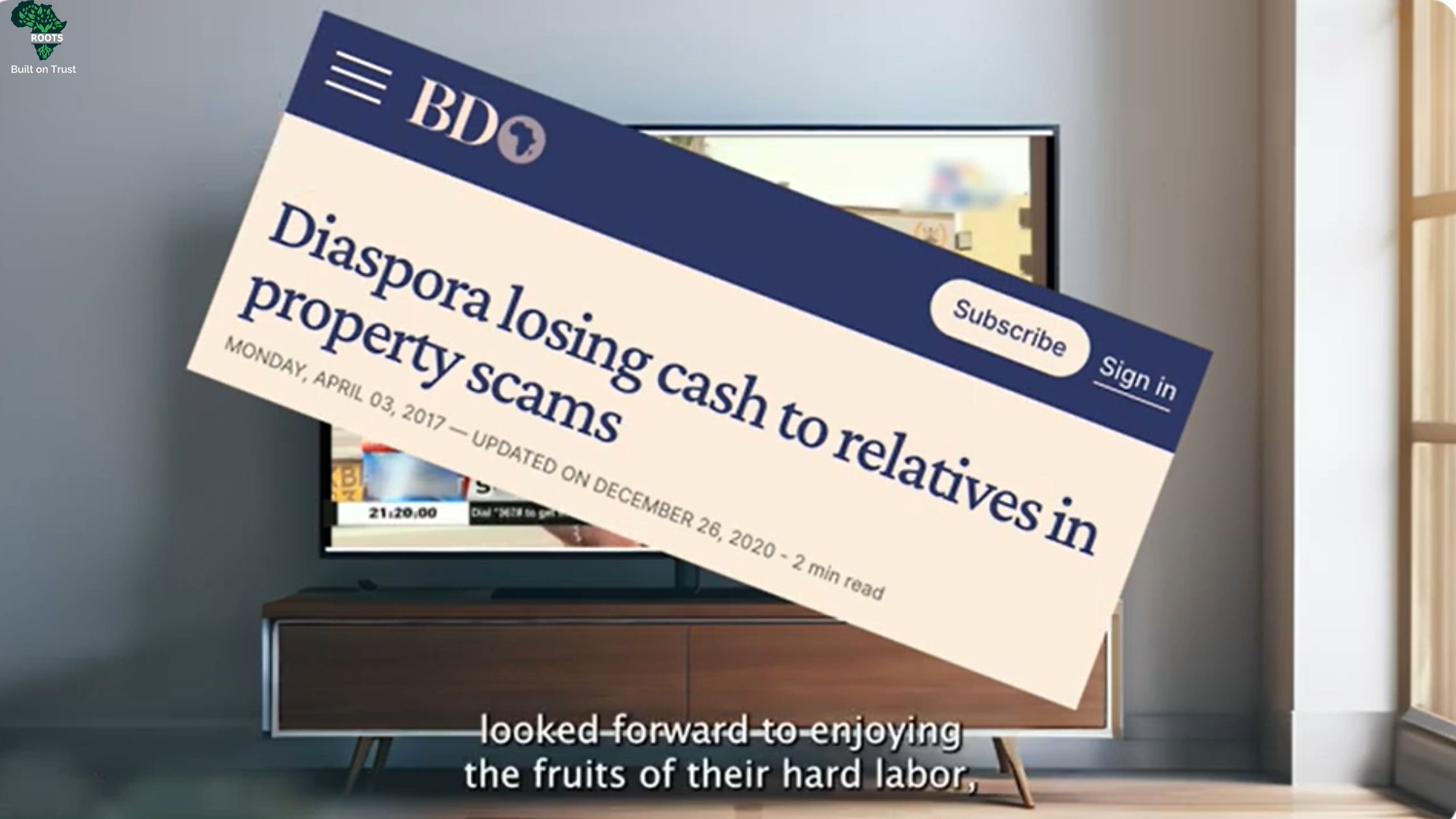

But here’s the paradox: while interest is sky-high, action remains low . Many dream of buying property but hesitate to start. So what’s stopping them? At Roots Africa, we’ve worked—we have conducted several surveys on this , and we’ve noticed a pattern. The barriers are real but they’re also beatable.

Let’s face it, real estate is one of the most preferred investment paths in Kenya, yet many aspiring investors hesitate to get started. Common fears like property fraud, high costs and lack of trusted information hold people back. There’s also the widespread myth that real estate is only for the wealthy , even though tools like affordable mortgages and reducing balance loan calculators have made property ownership more accessible. Without clear goals or guidance, many delay decisions, often missing out on prime opportunities in high-growth areas. By addressing these barriers with the right knowledge and support, more Kenyans can confidently take the first step toward real estate ownership.

A common misconception in Kenya’s real estate market is that you need millions to get started. While property for sale prices can be high, there are increasingly affordable entry points, particularly through mortgages and structured payment plans designed for middle-income earners. Understanding how loan repayment works is key and tools like a reducing balance loan calculator can help estimate what monthly payments would look like over time. As access to home loans becomes more flexible and tailored, especially for first-time buyers, real estate is no longer out of reach for those with modest income levels. The real challenge often lies in awareness—knowing what financing options exist and how to use them effectively to begin your property investment journey.

Navigating the real estate market in Kenya can be overwhelming, especially for first-time buyers or investors. From understanding the mortgage application process to choosing the right location for an apartment or property, the amount of information needed can be daunting. Without access to accurate guidance or trusted sources, many investors postpone decisions that could help them build long-term financial security.

To overcome this, it’s important to focus on education, follow reliable real estate blogs , engage in investor forums, and learn about topics like land ownership, property valuation, and financing options. Building knowledge around real estate processes, legal requirements, and available support systems empowers individuals to make informed decisions and move forward with confidence.

In Kenya’s real estate market, buyers and investors often have different motivations—some plan to build a home for their family, while others are more focused on flipping, renting, or holding property for long-term gains. However, without clearly defined investment goals, many people find it difficult to take the first step. Uncertainty about whether to prioritize rental income, capital appreciation, or personal use can lead to indecision. Clarifying your objectives early, whether you’re looking for financial returns, future security, or a place to settle, is essential to choosing the right real estate strategy. A clear purpose also makes it easier to evaluate property types, locations, and financing options that align with your long-term goals.

In the context of real estate investment in Kenya, many prospective buyers hold back, waiting for a higher income, more savings, or what they perceive to be a more stable or less risky market. While this caution is understandable, delaying too long can result in missed opportunities, especially in areas where property values are steadily rising. Real estate tends to appreciate over time, and even small investments, such as purchasing a plot on the outskirts of Nairobi or in emerging towns, can yield long-term benefits. Starting with what is affordable allows individuals to gradually build equity and gain experience, rather than waiting for the “perfect” conditions that may never come.

The Kenyan property market is full of potential—but only for those who take action. At Roots Africa , we’re making the journey easier, safer, and more community-driven.

From mortgage pre-qualification to verified listings and a powerful investor community , we’re helping aspiring investors move from “someday” to “today.”

Ready to get started—or still unsure? Join the waitlist for Roots Africa’s Local Investor Community and access trusted advice, vetted properties, and insider knowledge to help you take the leap.