Looking for the best way to build long-term wealth? Discover why real estate still outperforms shares, bonds, and MMFs in ROI and security. Learn how you can start your journey with a mortgage from Roots Africa.

— And Why It Beats Shares, MMFs and Government Bonds

When it comes to securing your future, choosing the right asset is everything. Today, middle-income earners are faced with a buffet of investment options—from money market funds (MMFs), stocks and shares, to government and treasury bonds. But one option continues to stand tall: real estate .

Let’s break down why property remains the most reliable and rewarding long-term investment —and why now is the best time to buy through Roots Africa’s affordable mortgage solutions.

Unlike shares and MMFs, which can fluctuate daily based on market sentiment, inflation, or political instability, real estate is more resilient . Property values in Kenya have shown a steady upward trend, especially in urban areas like Nairobi, Kiambu and Mombasa. While stocks may dip or MMFs drop in yield, land and houses tend to appreciate, even during economic slowdowns.

Takeaway: Real estate offers peace of mind. You can literally see and touch your investment.

Bonds and MMFs are essentially papers with a promise —useful, yes, but intangible. Real estate, however, gives you ownership of physical property —land, a home or an apartment—assets that can be rented out, lived in, or sold.

A piece of land in a prime location will always be in demand, unlike stocks that can lose all value overnight.

Real estate can be structured to provide you with monthly passive income through rental income. In contrast, MMFs and bonds yield modest fixed returns, often below inflation in real terms. Share dividends? Inconsistent and sometimes non-existent.

With the right property in the right location, real estate provides a predictable and growing cash flow , especially as rental demand in urban Kenya continues to rise.

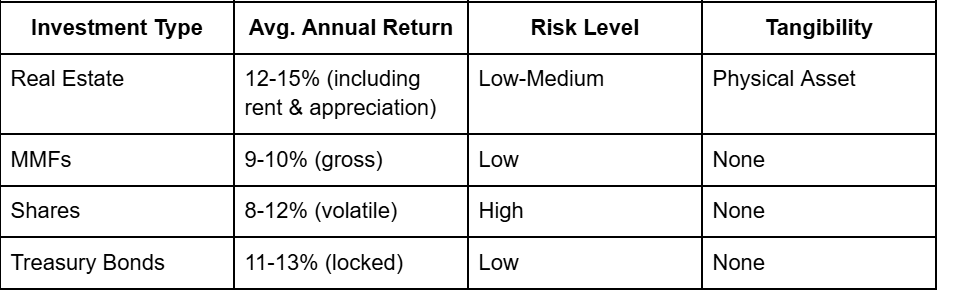

Let’s talk numbers.

While some financial instruments may match real estate returns in the short term, none offer the combined benefits of appreciation, rental income, inflation protection and long-term equity .

With real estate, you don’t need to pay the full amount upfront. Thanks to mortgages, you can own high-value property with as little as 10–20% down. Try doing that with government bonds or stocks!

This leverage effect lets you maximize returns while spreading payments over time, making property ownership far more accessible today than it was 10 years ago.

Unlike paper-based assets that may be hard to trace or transfer, real estate is generational . It’s an asset you can pass down. In Kenyan culture, land ownership is still one of the most respected forms of wealth.

Your investment can secure not only your future, but also your children’s, through processes like trusts.

While MMFs, shares and bonds all play a role in a well-diversified portfolio, real estate stands out as the ultimate wealth security tool , especially in a growing market like Kenya’s.

So why wait?

At Roots Africa , we make property ownership easy. Whether you’re buying your first home, investing in rental property, or building on your land, our mortgage solutions are tailored for middle-income Kenyans like you.

Apply for a mortgage today and secure your financial future with Roots Africa.