Discover how mortgages in Kenya are now more accessible than ever. Learn the step-by-step homeownership process, who qualifies and how Roots Africa can help you own a home, even if you’re self-employed or living abroad.

For years, owning a home in Kenya felt out of reach for many, especially young professionals, the self-employed, and the Kenyan diaspora. Mortgages were misunderstood, considered a luxury for the wealthy, or considered risky financial traps, but that perception is no longer the reality. What used to be an intimidating process is now a practical path to long-term wealth. Today’s mortgage market is more accessible and inclusive than ever before.

A mortgage is a long-term home loan paid back over time, typically 15 to 30 years. It allows you to buy a home now and pay in affordable monthly installments. For a long time, high interest rates (13–20%), short loan periods and strict requirements made mortgages unattractive. But with reforms and government-backed solutions, everything has shifted.

Here’s what’s different today:

Many people still believe outdated myths that hold them back from starting the process. Let’s break them down:

The reality is this: With a steady income, basic documentation, and no deposit or as little as 5-10%, most Kenyans, at home or abroad, can qualify for a mortgage today.

Here’s what the typical process looks like when buying a home with financing in Kenya:

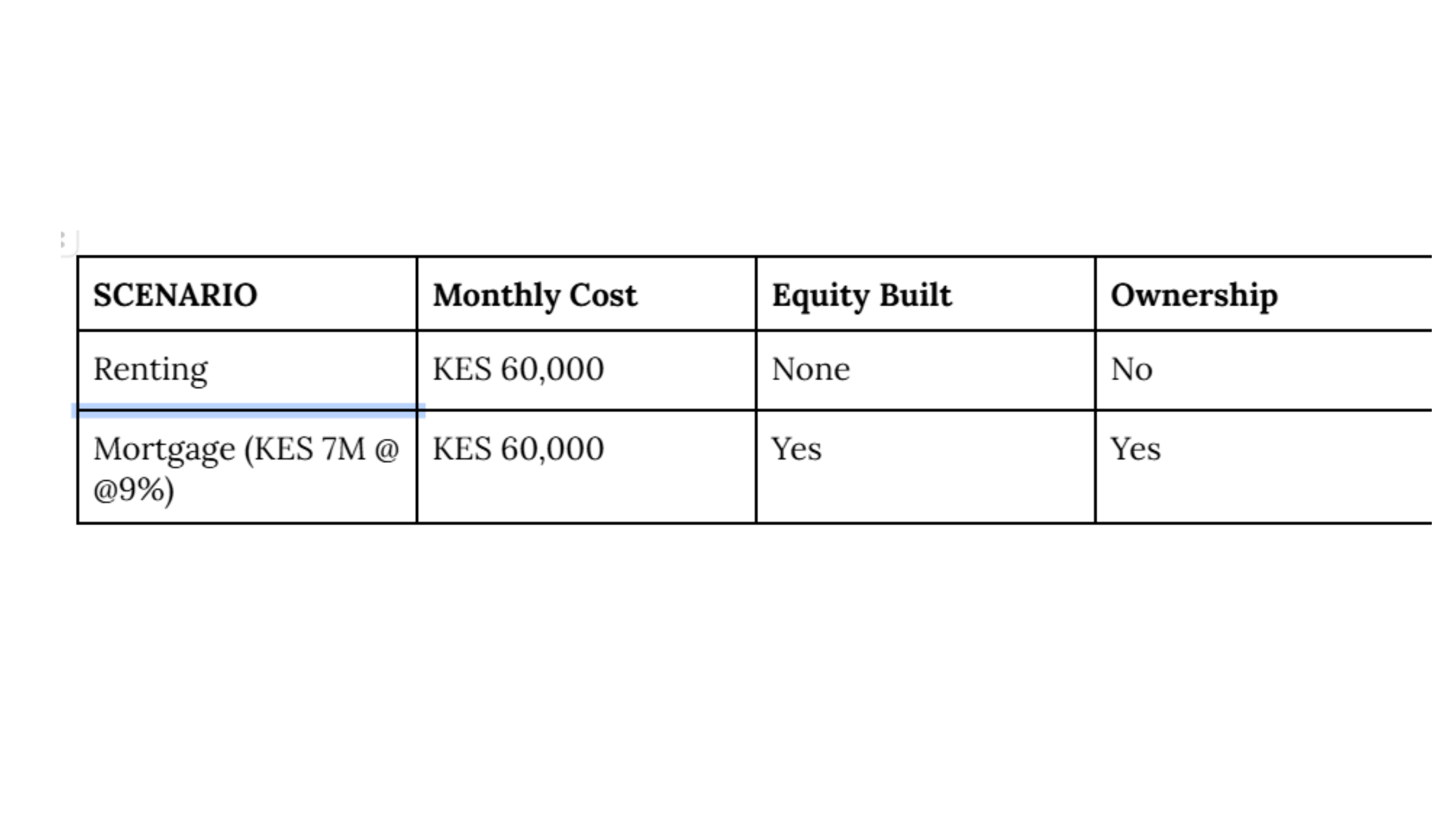

Let’s compare:

Same monthly spend but only one builds your wealth, credit and future.

At Roots Africa, we don’t just connect you to residential property — we help you build a life. We offer end-to-end support throughout your homeownership journey, starting with mortgage pre-approval assistance to help you understand what you qualify for. Our listings are fully verified, with clean documentation to give you peace of mind. We conduct thorough risk vetting and due diligence on every property , ensuring your investment is secure. And beyond the transaction, we provide ROI-based property advise, helping you make smart, long-term decisions that grow your wealth.

Whether you're in Nairobi or New Jersey, we walk with you every step of the way.

Don’t let outdated beliefs stop you from owning your future. Mortgages aren’t reserved for the wealthy; they’re available to you, now more than ever. You just need the right support and information to begin.

Let’s help you get started. Whether you're in Kenya or abroad, talk to us at Roots Africa and explore how we can make your dream of homeownership a reality.