Want to know what your monthly mortgage payment might look like? Learn how to use a mortgage calculator to estimate home loan costs, avoid surprises and plan smarter in your homeownership journey.

So, you're thinking about getting a mortgage.

You’ve been looking for property to buy, maybe even found the perfect apartment or a duplex for rent. Now you’re wondering—what’s it really going to cost you month to month? You don’t want guesses. You want numbers. This is where a mortgage calculator becomes your best friend.

But how does it work?

A mortgage calculator is more than just a fancy online tool. It’s a quick, no-commitment way to find out how much house you can afford, how much you’ll repay each month and whether the numbers make sense before you ever fill out a loan application.

Let’s break it down.

This is the money you're borrowing, not the full value of the property if you’re making a down payment. For example, if your new home costs KSh 8 million and you’ve saved KSh 2 million, your loan amount is KSh 6 million. A mortgage calculator uses this figure as the base for everything else.

This is the cost of borrowing, expressed annually. Even a small difference in interest rate, say, 11% versus 13%, can significantly affect your monthly payment and the total interest you’ll pay over time. Most mortgage calculators allow you to try different rates to see the impact.

You’ll usually choose between 10, 15 or 20+ years. A longer term means smaller monthly installments—but more interest paid overall. A shorter term means higher monthly payments, but you clear the debt faster. The calculator helps you weigh both options side by side.

Your down payment isn’t just about reducing your loan amount—it also affects your interest rate in some cases. Lenders love it when you bring equity to the table. A 20%-30 % deposit is often the sweet spot to avoid extra fees or insurance.

Advanced versions factor in other costs like property taxes , insurance and even maintenance costs to give a fuller picture of your monthly obligations. These aren’t always required but they help you avoid budget shocks later.

Because using a mortgage calculator puts the power back in your hands. You’re no longer at the mercy of lender jargon, surprise fees or "we’ll let you know after your application" tactics. With just a few numbers, you can predict your monthly repayment, compare different loan scenarios, and even see what happens if interest rates rise. You don’t need to be a financial expert. Just five minutes, a few numbers and you’ll know exactly where you stand.

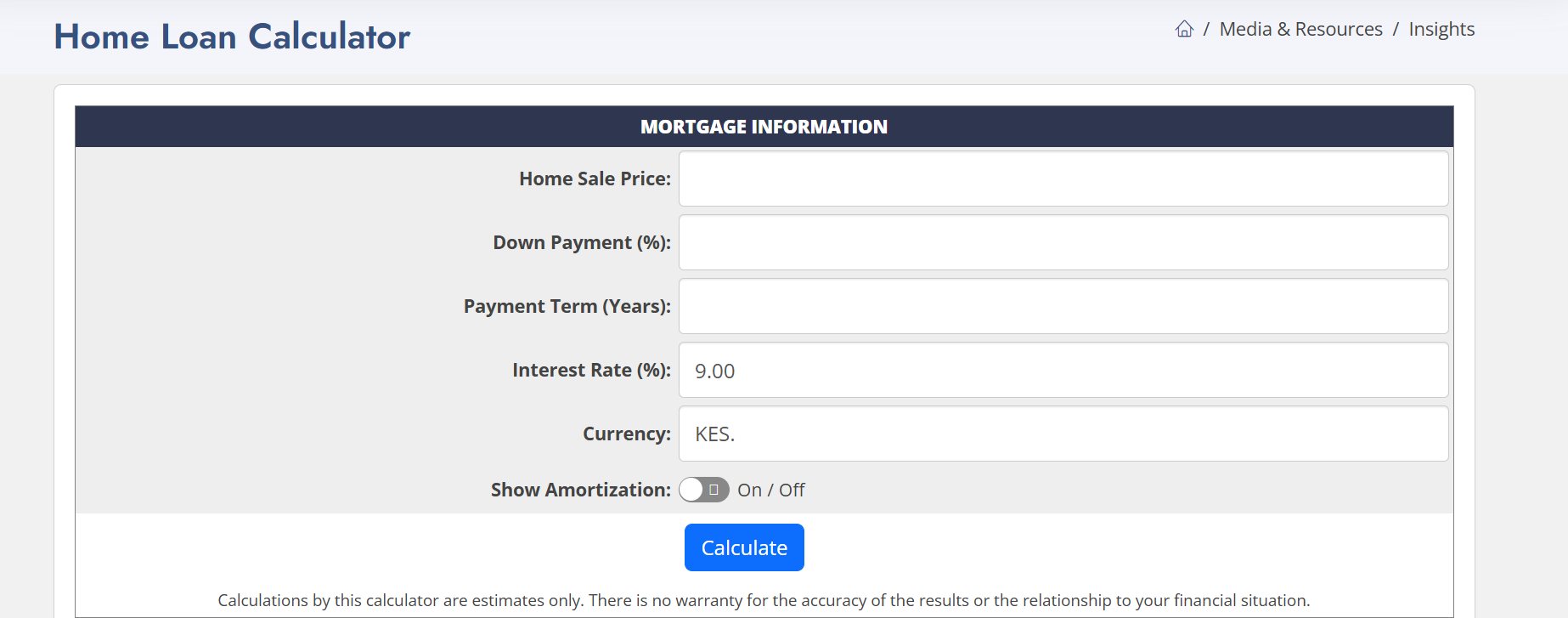

Don't fret. At Roots Africa , in partnership with one of our vetted mortgage partners , we believe getting a mortgage is more than just filling out an application — it’s a journey. We walk with you through every stage, from helping you understand the mortgage application process to linking you with our trusted financial partners who offer affordable interest rates as low as 9% , all the way to guiding you in selecting the right property that fits your budget and lifestyle. Whether you're buying your first home or investing in real estate, we ensure every step is clear, supported and aligned with your long-term goals.Mortgage Calculator

Reach out to us today to apply for a mortgage or make an inquiry. No pressure. Just answers, guidance and a clear path to homeownership.

Your future starts with clarity. Let’s help you get it.