From elite privilege to middle-class opportunity—discover how Kenya’s mortgage industry has evolved and why now is the best time for middle-income earners to own a home. Explore mortgage options and apply today with Roots Africa.

Not too long ago, owning a home in Kenya through a mortgage felt like an elite-only affair. For many middle-income earners, the dream of homeownership was out of reach, thanks to high interest rates, complex paperwork, and limited financing options.

But the tide has turned.

Today, the mortgage industry in Kenya is undergoing a major shift. Backed by innovation, regulatory support and partnerships between the public and private sectors, mortgages are now more accessible than ever, especially for Kenya’s growing middle class.

For decades, Kenya’s real estate market was primarily cash-based. Mortgages were rare, hard to qualify for and heavily skewed toward high-net-worth individuals. Banks were cautious and the limited demand made mortgage products expensive and rigid.

Key barriers included:

The result? Low mortgage uptake despite rising urbanization and a booming housing demand.

Over the last decade, Kenya has seen structural reforms and innovations that have opened up the mortgage space, especially to salaried workers, SME owners and young professionals earning between KES 50,000–250,000.

Commercial banks, SACCOs and fintech lenders are now offering flexible mortgage packages that suit different incomes, including joint ownership and Islamic home loans.

With interest rates dropping to below 13% and repayment periods stretching up to 25 years, mortgages are now more sustainable. Lower monthly installments mean more Kenyans can qualify based on income.

➡ Tip: Use a reducing balance loan calculator to estimate your monthly repayment. This model reflects how most Kenyan mortgages work—where interest is charged only on the remaining loan balance, not the full amount.

3. Affordable Housing Programs

Government-backed projects like the Affordable Housing Programme (AHP) have introduced home units starting as low as KES 1.5M, eligible for mortgage financing.

Platforms like Roots Africa are simplifying everything—allowing you to apply online , check your eligibility instantly, and get matched with vetted property listings and lenders.

Understanding what you can afford is key.

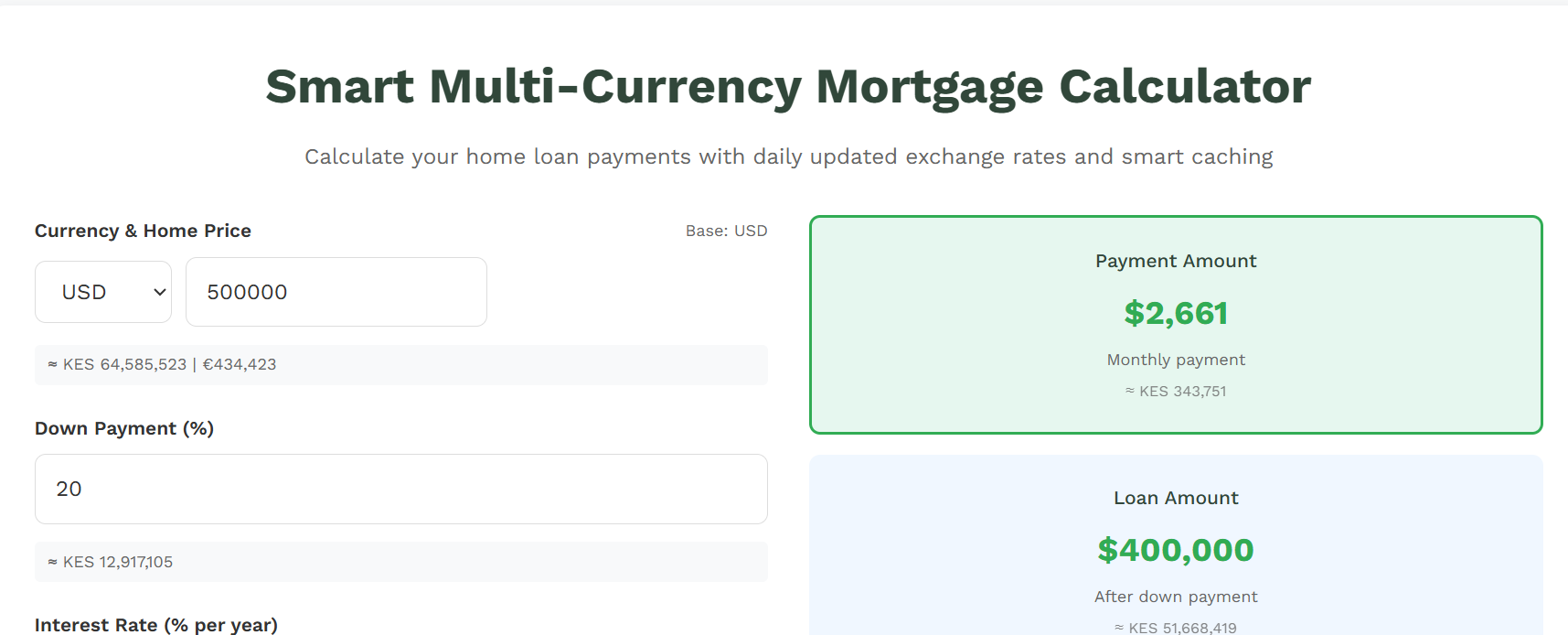

Use tools like:

This helps you make informed decisions and avoid surprises.

Kenya’s mortgage market is no longer limited to the rich. Here’s who can now access home loans:

Also available:

At Roots Africa, we remove the guesswork. We walk with you through:

✅ Check your eligibility now using our mortgage pre-approval form

✅ Calculate your loan with our in-platform reducing balance calculator

✅ Browse affordable homes suited for your income

The evolution of Kenya’s mortgage industry is more than a trend—it’s a movement toward inclusive, accessible homeownership . What was once a luxury is now a real, achievable goal for middle-income earners. Your moment is here.